Table Of Content

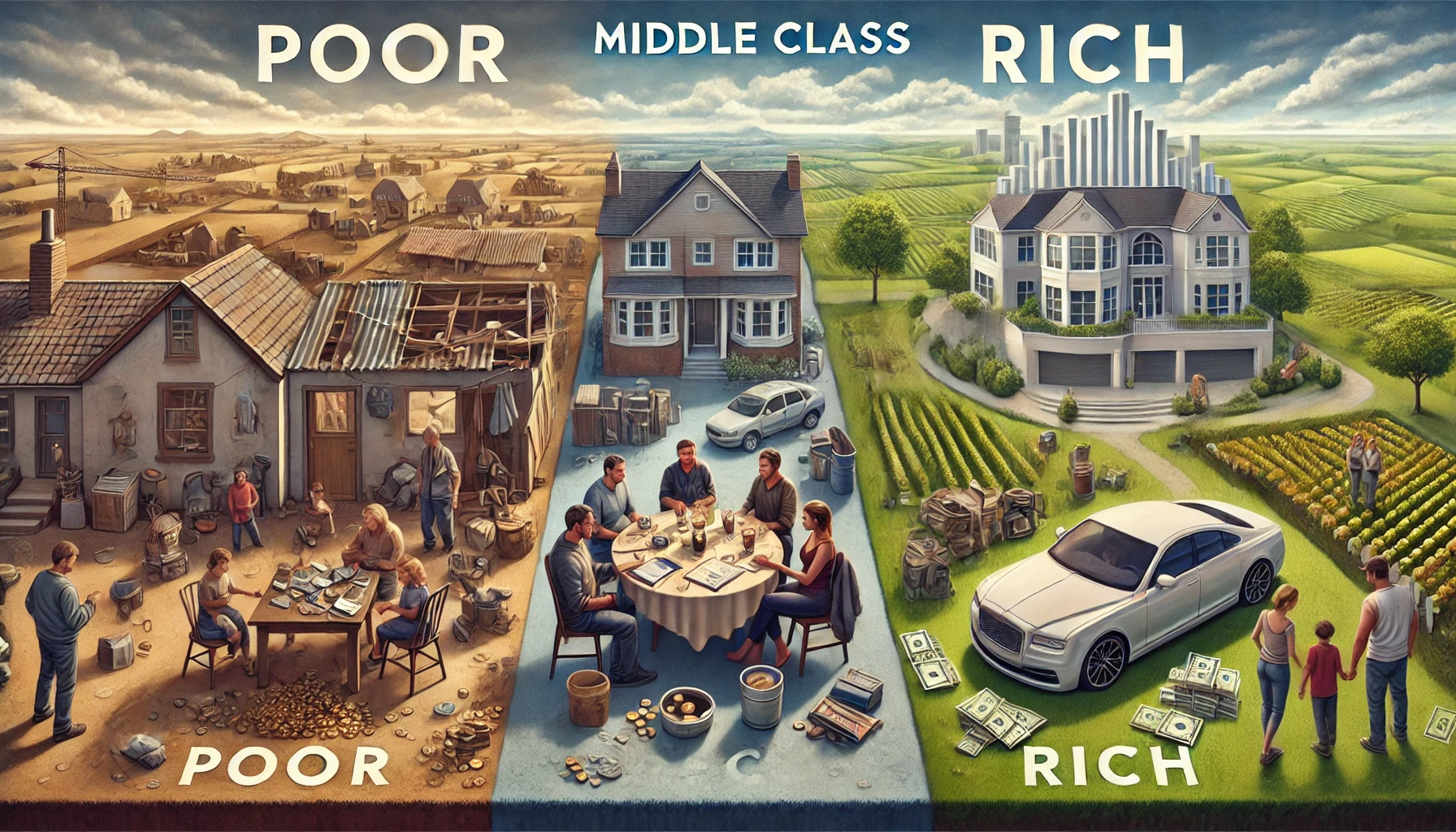

Poor people spend all their money, Middle Class saves all their money, Rich people invest all their money. Poor and Middle Class usually take on bad debt, while Rich take on good debt.

Living for the Moment: How the Poor Handle Money

For the poor, the struggle to manage money often becomes a desperate battle to make ends meet. Most earnings go to basic needs like rent, food, and utilities. It’s a paycheck-to-paycheck existence. Immediate survival will be in the way of long-term planning. Saving and investment become unreachable and seem a luxury only others can afford.

The Safety Net Mentality: The Middle Class Approach

The middle class seeks security, usually by putting effort into saving. Every dollar saved seems to act like a shield against uncertainty. Emergency funds, retirement accounts, and modest, low-risk investments are the hallmarks of their financial strategies. This cautious mindset brings stability but often leads to missed opportunities. By not making investments that yield higher returns, the middle class often finds itself stuck, unable to grow its wealth beyond a certain point.

Money as a Tool: How the Rich Build Wealth

The wealthy do it completely differently. They see money not as something to be hoarded but as a way to make more money. Rather than accumulating money, they invest in assets such as real estate, stocks, or businesses that generate returns. They understand the magic of compounding and take calculated risks to grow their portfolios. The focus is on building wealth that works for them, creating passive income streams and long-term financial independence.

The Debt Divide: Bad vs. Good Debt

Debt can be a financial anchor or a stepping stone-it all depends on how it’s used. Poor and middle-income individuals generally carry bad debt, which comes in the form of high-interest credit cards, payday loans, or personal loans for non-essential expenses. This kind of debt provides no long-term benefits and can easily spiral out of control. The rich, on the other hand, leverage good debt to gain appreciating assets. Examples of such good debt include a mortgage on a rental property, a loan for education, or funding for a business. All these are debts that can potentially generate more income or appreciate in value over time. This is one of the key fundamentals of building wealth.

Technology as a Catalyst: How AI Empowers Financial Growth

Artificial intelligence is revolutionizing how money is managed, delivering tools that level the field in wealth creation. AI-enabled applications offer personalized guidance that helps in smart budgeting, reduction of unnecessary expenditure, and making informed choices in investments. Such platforms will also help educate users about good debt versus bad debt to make smarter borrowing decisions. By democratizing access to financial resources and strategies, AI bridges the gap, allowing those in lower income brackets to adopt the habits of the wealthy.

If you want to break free from financial stagnation, it’s about shifting your habits. Spend with intention, save wisely, invest for growth, and leverage the tools available to you. With AI as a guide and the strategies of the wealthy as inspiration, a more secure financial future is within reach

Leave a Reply

You must be logged in to post a comment.