💳🏦💰 Banking

What does the term banking industry bring to your mind? Maybe it’s the safekeeping of your hard-earned money or obtaining a loan to finally buy your dream house. However, banking has grown beyond this role. It has transformed into an elaborate, all-encompassing ecosystem serving varied financial needs. While embracing many day-to-day transactions of bill paying, transferring funds, and the like, the banks have grown to support one from the cradle of existence through most vigorous long-term investment strategies. They are silent yet strong partners in mentoring us through the labyrinth of managing money, planning for future security, and navigating this almost overwhelming landscape of financial choices.

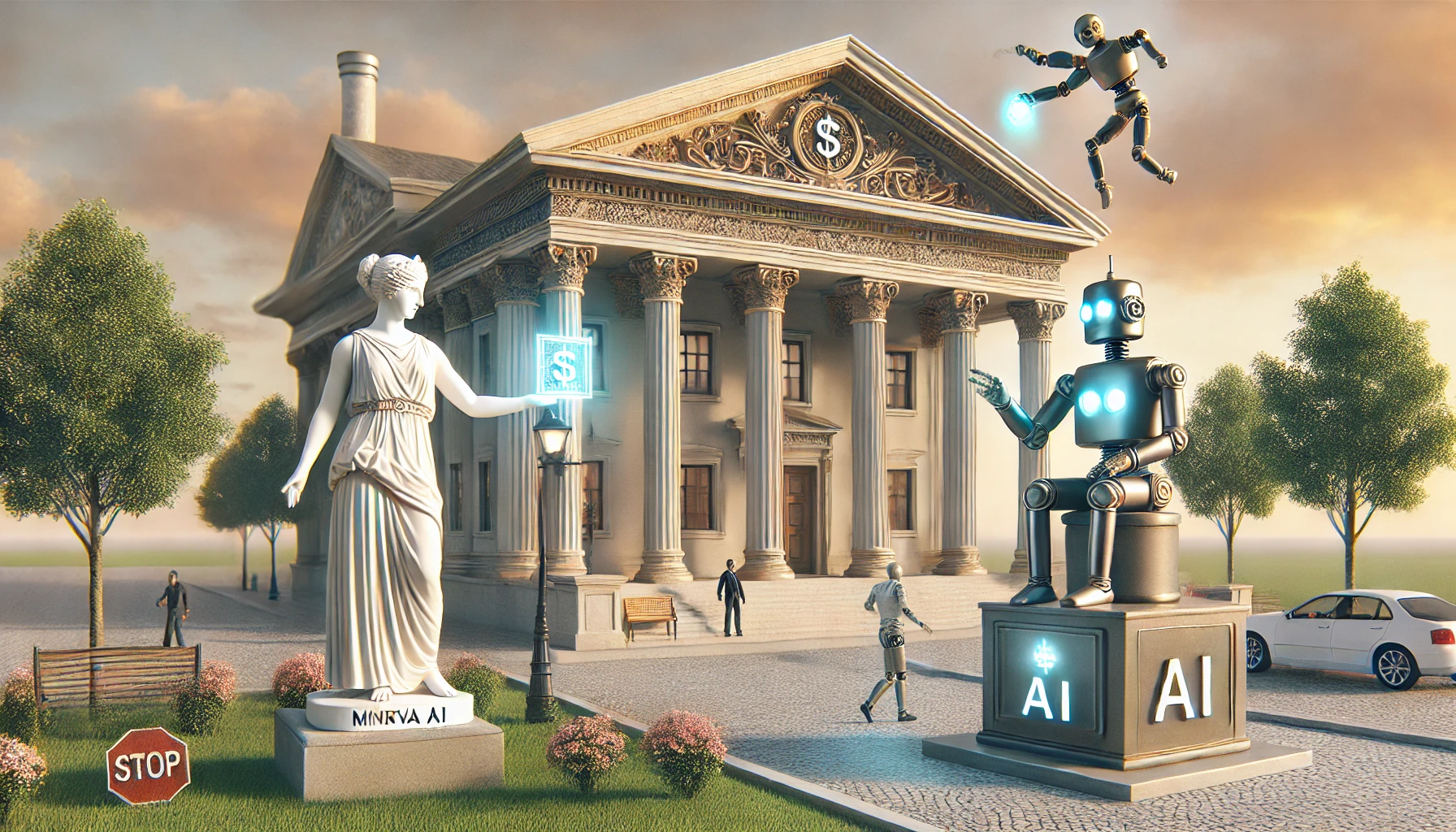

A Fresh Perspective on Banking as AI takes Center-Stage in it.

Now, let’s turn to the exciting shift in this key sector-artificial intelligence, or AI. Think of AI not as just a tool but as an enterprising and intuitive financial partner who is ready at any moment to give you new insights into your world of finance. Banks and other financial institutions are riding the wave of AI to take banking to the next level and into an era of personalization, efficiency, and convenience. Gone are the days when banking was a time-consuming affair and one had to invest much time in doing lots of monotonous paperwork; AI enters, changing the way one interacts with his finances.

What if each time one entered their bank or opened the banking app, it was an AI-powered virtual assistant greeting them? Not a digital voice but a knowledgeable companion which remembered financial history, grasped the present need of a customer, and might even give personalized pieces of advice on how to best optimize savings and investments. From budgeting to investment strategies, it can also advise one without having to set an appointment or wait in a line for this.

Most impressively, though, is the role AI is playing in asset protection. Today, financial institutions use very sophisticated algorithms that identify and repel fraudulent activities in real-time; with it, it protects your hard-earned money. The algorithms learn and adapt, hence catching patterns that humans may miss, flag suspicious activities before things escalate. Where document processing is usually involved, the most mundane task of all, AI again leads the pack in automating workflows and making seamless those processes that took innumerable hours of human labor.

And, of course, there are AI-driven chatbots-available at any time of day or night-acting as smart assistants that can answer your questions, facilitate money transfers, update you on your accounts, or address any dispute about a transaction without you having to visit a branch or wait until office hours. This stuff, which might have seemed some pipe dream of the future, is part and parcel of everyday banking today, imbuing ease, efficiency, and-most of all-security into our lives.

This is a whole different world opened to banking with AI-it is not just an upgrade. It is the time when banking went from being a routine to an intelligent, seamless companion in your financial journey. So, the next time you are thinking of the banking industry, don’t just think of big vaults and checkbooks; think of a world where smart, responsive technology will completely redefine what it means to bank in these modern ages.

Minerva AI

Minerva is an AI-powered risk assessment platform, offering anti-money laundering at scale. The solution uses neural networks and deep learning models to analyze billions of data points and sources for context, sentiment, and risk in real time across structured, unstructured, open-source, and proprietary data.