Table Of Content

The Minerva AI technology that works around 147 languages helps compliance teams stay ahead of financial crime, prevent money laundering, and meet government regulations. According to Minerva, AI-based automation returns results 300 times faster and decreases costs by 55%, compared to manual processes.

What Minerva Does

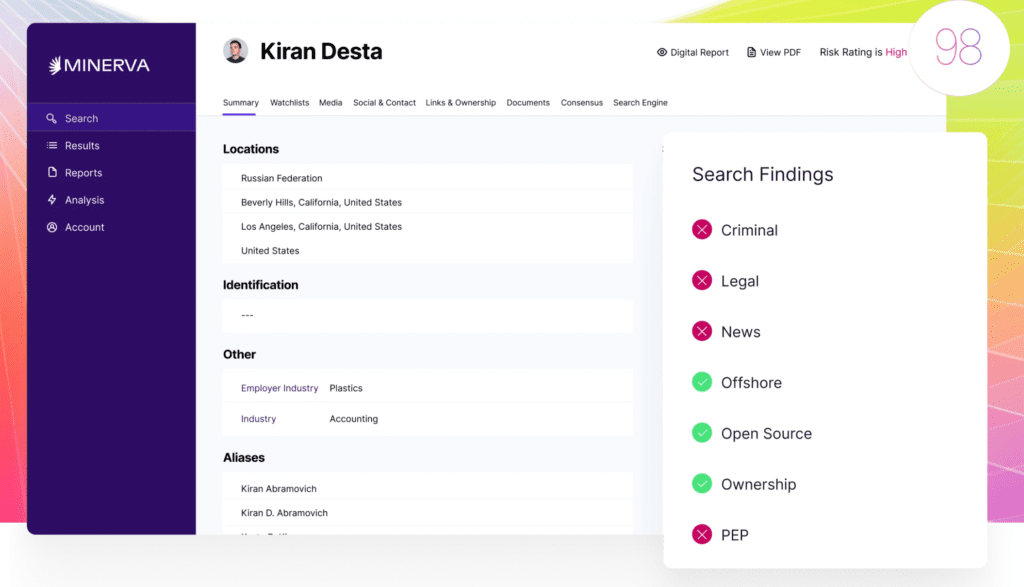

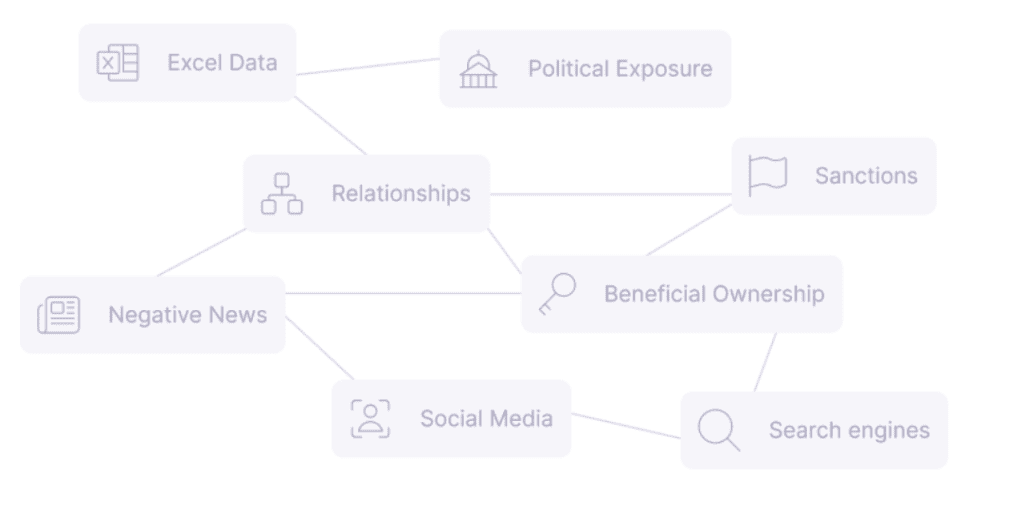

Minerva AI offers a unique platform for the automation of Anti-Money Laundering compliance, Know Your Customer procedures, and ongoing risk assessments. Built for both large and small financial institutions, fintech companies, and crypto exchanges, Minerva makes sense of an otherwise complex compliance process. It accomplishes this by applying AI models that are trained on millions of decisions, sifting through large datasets in real time, reducing false positives by up to 75% and investigation time by 300x compared to manual means. This helps free the teams for deep analysis instead of document management.

How to Use Minerva AI

Minerva provides real-time onboarding of customers and risk monitoring. The platform offers an out-of-box API that takes only days to implement, set up for continuous monitoring of Sanctions Lists, Adverse Media, and PEPs. Its real-time analytics make for speedy decisions on which customers to onboard while flagging suspicious ones. Minerva creates auditable reports automatically; hence, it offers fast and painless regulatory submissions.

Pros

- Speed and Accuracy: Minerva processes billions of data points in seconds, delivering insights at 99.6% accuracy.

- Cost-Effective Compliance: Automates workflows to reduce compliance costs by half.

- Customizable Risk Ratings: Set up risk tolerance levels to suit your organization’s needs.

- Easy Integration: Simple API With simple API setup, you’re live in a few days.

Cons

- Heavy Reliance on AI Models: Some smaller-scale organizations may find the automation overwhelming without initial guidance.

- AWS-Centric Deployment: Although this may be useful for AWS customers, for those who are not using AWS, this may be a bit constrictive.

Pricing

Pricing Minerva Subscription Plans Minerva has flexible subscription plans. There are self-service and customized subscription options. Enterprises can purchase services from the AWS Marketplace to facilitate easy integration. There are private subscription models with extended support options for highly demanding customers.

Use Cases

- Financial Institutions: Automate your customer onboarding with KYC and AML in accordance with global regulations.

- Crypto Exchanges: It ensures the detection and blocking of high-risk accounts while ensuring seamless onboarding experiences for users.

- Gaming & Casinos: Institution of fraud prevention through continuous risk monitoring at scale.

FAQs

1. How does Minerva AI reduce false positives?

It provides contextual understanding that differentiates the signal from the noise, thereby reducing false alerts by as much as two orders of magnitude while guaranteeing true investigation value of the cases.

2. Can I create customized risk models with Minerva for compliance purposes?

Yes, it provides risk ratings customizable to your risk appetite and business needs.

3. How long does it take to implement Minerva?

Using a simple API integration, Minerva’s deployment can be done in as short a time as five days.

Leave a Reply

You must be logged in to post a comment.